Dear Datuk Seri Dr. Mahathir,

Sorry for the delay in not writing earlier (a follow to my letter date 13th June 1998), I had to get back to my real job. Hong Kong wants to be the first country in Asia to recover from this slow down, why don't we beat them to it. My guess is that we have almost reached the bottom and it'll be easier to climb upwards very soon. There should be another bull run some where in the year 2000 to 2003. The river is running dry and the plants (manufacturing?) along the river bed are drying up. It looks like we may not have enough water to overflow onto the banks (financial?) but no one told us we could not raise the river bed, did they?

Historically, a slow down in the car sales has had considerable impact on our economy or a slow down in our economy has caused a drop in car sales. Whenever there was considerable interest rate increases or restrictions on the loan repayment to less then five years, car sales were severely affected. This is a clear indication that our car prices are too high and I suspect bordering on unaffordable. (Seven year car loans! Are we buying a house or a car?) I believe that the 'success' of Proton cars sales in Malaysia is due to Malaysia being a closed market, they cannot effectively compete if there were no restrictions on the import of foreign cars, hence their inability to export substantial quantities overseas.

I read somewhere that the outflow of capital was the order of US$32 billion, our reserves being US$20 billion. As I cannot find the article, just now, please bear with me if I am in error. The outflow is equivalent to RM120 billion, now. This is an equivalent of 2,666,666 Proton Wira cars exported. Or 100,000 SMI companies exporting RM100,000/- each per month for a year (or 10,000 companies exporting RM1,000,000/- per month for a year). Or approximately 48 years of Natural Rubber production, based upon NR prices at RM2.50/- per kg instead of approximately USD$1/- as quoted before the devaluation. I hope you can follow where I'm going.

The car business is big business. It supports a whole range of industries, metal, fibre, plastics, rubber (synthetic and natural), glass, insurance, financing, spare parts, repairs, servicing, petroleum, batteries, bulbs, cables, tires, accessories .. you name it. As early as November '97, we were aware of the drop in car sales and by January '98 some Proton suppliers were on one fifth production volume. And those who supplied to the suppliers were hit badly. Improving car sale can help revive the economy. I suspect that many SMI's are not coming forward to apply for loans as they do not expect any sales in the near future in order to pay off these loans. Why borrow when you cannot repay? So how do we boost the local car sales and in so doing boost the economy?

I ran a simple model of another type of consumer market on my consumer market program to get an understanding of the demand - supply workings, as I do not have enough data on the car market. It appears that the market, or rather the purchasing power of the market (the number of buyers with the cash available to purchase an item), has shrunk by about 50%. Hence maintaining the current high car prices will not get us any where. Car manufacturers can help revive the economy if they bring down their car prices by about 15% to 20%. By doing this we should be back to the old sales figures. Stripping a car of all accessories will not help, as the industries associated with those accessories will not recover.

As I have worked in the accessory industry, I know that Proton does mark up accessories by at least 100% and may be as much as 300% without any real value attached to the mark up. Furthermore they do not bear any cost of replacement or guarantee, should the accessory fail within the warrantee period. It is the accessory supplier who does. The industry practice is that of a 11%-15% mark-up for a middle man role. Hence high mark-up of accessories is a wasteful burden upon the consumers.

I believe that by dropping the accessories Proton had only able to drop car prices by about 10%. There is no greatness in this due to the high mark-ups that were in place.

We need to implement some form of real value to our cars and seriously look at cost reductions. Currently, Proton suppliers are being asked to lower their prices substantially, whether this is realistic or will affect quality is left to be seen. What I, as a consumer, would like to know is, what is Proton doing to bring their selling price down (as opposed to supplier cost)?

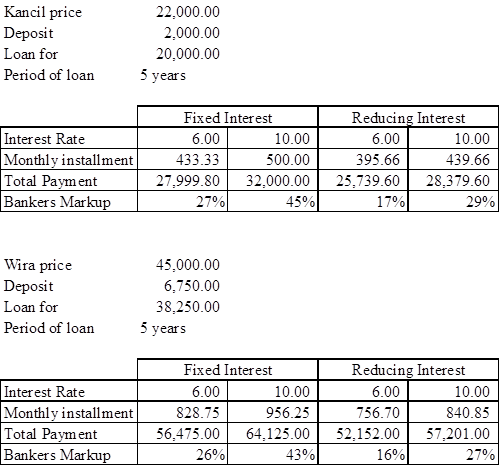

There is another option we can look at, which I believe will work. I strongly feel that the authorities should seriously look into the loan calculation mechanism. Currently, car loans are calculated on a fixed interest basis. That is, if you planned to purchase a Perodua Kancil for RM22,000/- and paid a deposit of RM2,000/-. You would have to take a loan of RM20,000/- over a period of, lets say five years. At an interest rate of 6% per annum you would have to pay a total of ((6%*RM20,000*5years) + RM20,000) = RM26,000/- or RM433.33/- per month. At an interest rate of 10% the total repayment would be ((10%*RM20,000*5years) + RM20,000) = RM30,000/- or RM500/- per month. This is a 15% increase in the 'price' of the Kancil as seen by the consumer. The loan itself contributes to up to 27% to 45% of the purchase cost of the Kancil!

Lets look at the Wira which cost around RM45,000/-. The deposit of 15% would be RM6,750/- hence a loan of RM38,250/- would be required for a period of five years. At an interest rate of 6% per annum you would have to pay a total of ((6%*RM38,250*5years) + RM38,250) = RM49,725/- or RM828.75/- per month. At an interest rate of 10% the total repayment would be ((10%*RM38,250*5years) + RM38,250) = RM57,375/- or RM956.25/- per month. This is a 15% increase in the 'price' of the Wira as seen by the consumer. The loan itself contributes to up to 25.5% to 42% of the purchase cost of the Wira!

Normal business practice, is to mark-up by 25%, but at a 10% rate of interest the banks and financial institutions are marking up the price of cars by 45%!!! At a 12% interest rate the mark-up by the banks would be 51%! What additional value has this added to the car? No wonder our economy has nose dived.

I believe that we should calculate interest rates on a reducing interest rate basis, as is done for housing loans. If this is carried out the owner of a Kancil will pay RM395.66/- per month for a 6% loan and RM439.66/- per month for a 10% loan. The owner of a Wira will pay RM756.70/- per month for a 6% loan and RM840.85/- per month for a 10% loan.

This is a more affordable and realistic pricing which could be improved upon with price reductions on cars. Furthermore as repayment amounts are lower the risk of bad loans is reduced. Hence we will be back to the days when buyers could pay off car loans within three years, as was the case 15 years ago. The table below shows the difference in perceived prices of cars based upon the current fixed interest rate and the proposed reducing interest rate calculation for cars. The consumer's mobility will also contribute to local tourism.

The total payment indicates the effective car price after including the cost of the loan. We have not considered the cost of insurance!

I would like to see the Malaysian cars exported in large numbers but for this to happen, higher volumes and lower margins with valued added quality (not price) have to be the order of the day which Malaysians should enjoy. Lets not wait for Japan to recover, I believe that there is plenty that Proton & EON and the banks can do to help revive the economy.

PS. The next bull run will be around the year 2000 and the next market

crash will be around the year 2001. I'm releasing this information as

long as it will not be considered as 'insider' information as it is a

mathematical prediction. (hand written PS)

.....

an engineer

This article on the 3rd letter to PM was reproduced here by Dr. Peter Achutha - 24 December 2017.