Dear Datuk Seri Dr. Mahathir,

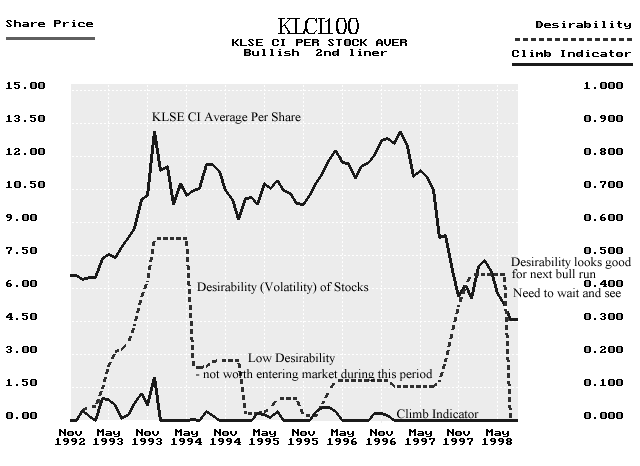

I have done some initial analysis of our KLSE CI so as to predict how the market in general will behave. The graph below is what my program has provided currently and how it rates the KLSE in general, based upon the fact that "if we could trade the CI" that is it is looking at the CI as if it was a stock listed on the KLSE to determine how it would fare in the future. (The CI was divided by 100 as 100 stocks go to make the CI).

The concept of Desirability is one that I developed to tell me at a glance how the market is moving and to sort out which is the most profitable stocks to invest in. Desirability reflects how much a 'swing' in price a stock has. That is if the desirability 'energy' or value is high the stock will climb better in the next bull run. (I have seen stocks with a desirability of 15 and which have gone on to climb by x10 in price but desirability will be misleading if one assumes the desirability is the factor of climb i.e. a value of 5 does not mean the price will climb by x5). From around May 1994 to November 1996 the desirability of the KLSE was very low, in fact my program has avoided putting money 'into' the CI and has actually been selling off any shares it had held. The Desirability index has climbed late 1997 indicating that the market is becoming attractive to invest in.

The curve drops to zero in May 1998 as there is insufficient data (no data as it is currently July 1998) to show how the market is moving. If this curve keeps climbing into late 1998 it could mean the next bull run would be as good as the 1993 run, that is there will be plenty of money to be made on almost any stock provided an investor buys in early. If all goes well (we manage to recover) the current indications is the CI may climb by as much as x2-x3 in the next bull run. We will need to wait about six months (or more) to see how the desirability function moves to draw any further possible conclusions.

Do note that my program has classified the CI as a 2nd linear - the best classification. This indicates that there is a very high probability of good swings in the stock prices (ability to climb) and good money to be made by buying when prices are low and selling when they are high. The program classifies stocks into four categories, namely 2nd linear, blue chips, dead stocks and unknowns in their order of profitability. These terms have a slightly different meaning as compared to their usage in the securities industry.

Also my program has classified the KLSE CI as bullish even though the share prices are falling.

The other indicator I have, which is not shown here, is that of a 'moving indicator' that lets me know whether a share price is at a selling value or buying value. This indicator showed that the 1994 to 1997 CI was too high for good trading - virtually always in the sell and get out position..

There is still a lot more research that needs to be carried in order to identify bullish stock exchanges and the best climbers. I think that money can take on quantum values (a particle type of behaviour) where as economies are a flow of these quantum values and obey wave theory. It is this wave behaviour that allows me to predict trends years ahead. Since this is the physics of nature, the duality, these are God's laws. May God help us in these times.

I suspect that the financial people misunderstood the 1994 - 1996 KLSE performance. They should have conserved liquidity years ago. On the whole I think you have taken the right direction in curbing bankruptcies, preventing interest rates from rising too much and pushing extremely hard to bring in foreign investments.

Looking back, I had always thought that the Americans were a people who believe in freedom, democracy, justice, "In God we trust", hard work and prosperity - the American Dream and were like a stabilising / policing force in the world. Now, I just do not understand why some of them are trying out a reverse role. The Gulf War had an impact on the stock markets which even until today is visible. This impact, I believe is the rebound of stocks after the main fall. That is the KLSE took a year to fall but a rebound occurred in February / March 1998. At the moment I am unable to prove it as I do not have CI's of other Stock Exchanges. Due to the magnitude of the currency attacks across several nations and the severity of the fall of their Stock Markets, I believe that very many other nations will see this impact on their stock exchanges as very severe falls in their stock markets, for years to come. This falling wave will propagate across all nations. Did the currency traders induce an economic Extinction Level Event? Some quick action must be taken to help the Asean nations to recover quickly before this wave front has any impact. Let us see what the experts say.

.....

an engineer

This article on the 6th letter to PM was reproduced here by Dr. Peter Achutha - 24 December 2017.