| |

Nineth letter to Malaysian PM

The Letter written on 21st October 1998 to the editor of NST

To: The Editor,

New Straits Times,

31, Jalan Riong, 59100 Kuala Lumpur

Fax: 03 - 282 1434

Fr: Mr. Achutha A/L Dr. Marimuttu Balasundram

XX, Jalan XX/XX, XXXXX PETALING JAYA

Tel: 03 - XXX XXXX

Date: 21st October 1998

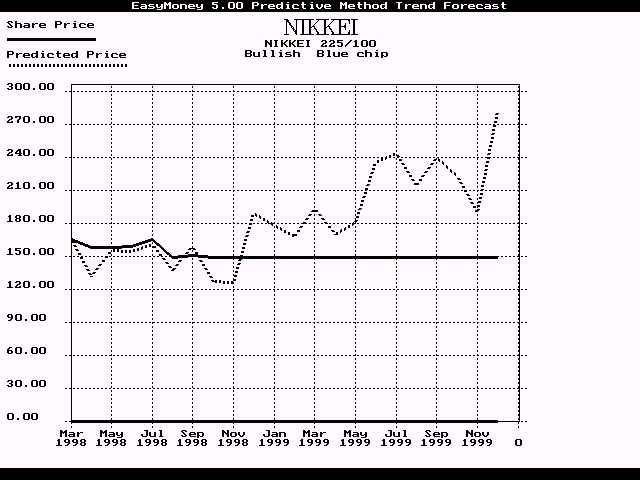

RE: Predictions of the future of the Nikkei 225

Dear Sir,

I really didn't expect to write another letter, but since I am aware that there is a need to raise funds Danaharta/Danamodal I am praying that my programs predictions will turn out to be correct and help contribute to the economic recovery. I wrote to somebody in one of the securities companies, but since they have not received my letter I am writing to you.

I managed to extract sufficient data from the "Smartinvestor" magazine (Issue 76, 5th - 19 Oct 1998) on the Nikkei 225, page 16 (the DJI graph had too little data). And used it to try to predict how the Japanese market will move. The data is not the best as I read off the values at the 'bridge' between the parallel vertical lines. I do not know whether this is the correct way to read the chart, but I'm trying. I have never tested my program on non-Malaysian stocks hence this will be a first attempt. Secondly, I do not want to look like Moody's or S&P rating agencies as I really do not know what is happening in Japan. I was only doing this to test my program and theories and I guess I needed an impartial independent witness.

The graph below is a prediction of the Nikkei 225. The values used are Nikkei values divided by 100 as if I had taken the actual Nikkei values the graph would appear very flat as my program insist on drawing graphs from 0 value at the origin. (another thing I have to change in the program). This is a touched up graph, in that I adjusted it for what appears to be closest fit to the actual Nikkei value between February and September 1998. It appears that the Japanese market is ready to climb very soon. The initial climb beginning any time between Oct and Dec '98 and can last for up to 3 months. Is there any other way to verify this as I prefer to be cautious at this moment as I have never analysed Japanese stocks.

The new technology indicates that the primary movement bottomed some where in March 1998 and the secondary movement bottomed in September 1998. I believe that the general trend is for the Nikkei 225 to climb until August 1999 - a climb in the primary movement is a bull run. Give some tolerance for the errors in the data, the global financial crisis has not badly affected the Japanese economy and that the currency speculators do not have a go at Japan. As I am not living in Japan I am unable to read the grassroots confidence levels or have an understanding of the real situation.

If this is correct may be the PM / NEAC should be informed so that it can be determined whether funds can be raised on the Japanese market. The point that needs to be considered is that unlike the KLSE CI that can climb by x2 in a bull run the Nikkei climbs by x1.5 only. Datuk Seri Dr. Mahathir's timing on the controls was very shrewd. You would notice that although most, if not all, the ASEAN nations are on a similar wave pattern (a superficial examination), Malaysia's was the only one that responded substantially - indicating that we have managed to maintain the underlying natural economic rhythm - the remedies are working. Could you please inform them?

Below is the graph based upon the older technology. (One day, when I have enough funds, I will combine the two technologies).

(Touch up code #3481)

A note on my predictions:

No attempt is made to look at the money supply situation and my program is very spiky hence the predicted values of highs and lows may not occur. The research work has always been on the shape of the share price trends especially in attempting to predict the timing.

The predictions are not definitive in that it is not 'nothing can be done' to change the out come of an economy or a company performance. The predictions attempt to show the underlying natural movement in share price trends. Heavy speculation and powerful market manipulation can change the characteristic of the share price trend. Also corrective action can be taken to counter unwanted trends.

Since the forecasts are for a few years ahead it is impossible to take into account unknown future events.

Thanks and best regards,

.....

Achu

an engineer

P.S.

Dear Sir,

I'm having great difficulty finding venture capital or investors as I'm stuck in a chicken or egg situation. If you could please help, is there anyone or any organisation/company whom I could contact to help me.

Thanks,

This article on the 9th letter to PM was reproduced here by Dr. Peter Achutha - 24 December 2017.

| Please donate. It would go a long way to provide you with great and original articles |

|

|

|

|