What is inflation and how to manage inflation

What is inflation rate?

Inflation is the condition where prices rise year by year. It can be the price of petrol you fill your car, it can be the price of chicken or fish in the market, it can be the price of property or rent for a property. Some countries have an rate of inflation of 2% and other countries suffer from inflation rate of 8%. A 2% inflation rate is pretty low and means that if you paid $100 for goods today, next year, on the same day you will be paying $102/-. An 8% inflation rate is actually quite high. It means that if you paid $100 for goods today, you will pay $108 for the same goods next year.

What does inflation do?

Let us say, you are earning $3000 per month today and were renting an apartment for $1000 per month and spending $1000 per month on groceries. Then you expenses would be $2000 per month and that would leave you with $1000 spare to pay your taxes and other expenses or for savings. If inflation rate was at 8% then next year you would be spending $2000 x 1.08 = $2160 and you would have only $840 to spare. You excess cash in hand has dropped by ($1000 -$840)/$1000 x 100 = 16%. That is shocking! That is how inflation quietly eats away at your surplus cash. You don’t notice it because you thought you were paying an extra 8%.

If you were earning $3000 per month and your expenses was $2500 per month that would leave you $500 spare cash, not taking into account taxes. At 8% rate of inflation your expenses next year would be $2500 x 1.08 = $2700 and that would leave you $300 spare cash. Did you notice that your spare cash for savings or other unforeseen expenses, has dropped by ($500 - $300)/$500x100 = 40%?

Everyone tells you about the increase in your expenses, but I will show you the other side of the story. The less you have the more inflation eats away at it. This is the basic reason inflation affects the poor more severely than the rich. Sounds familiar? I quote Matthew 13:12 “Whoever has will be given more, and they will have an abundance. Whoever does not have, even what they have will be taken from them.” Sounds like inflation, doesn’t it? Sounds unfair doesn't it? But that is the reality of this world. So start saving.

How to manage inflation

Inflation or rather high inflation rate is very horrible, isn’t it? What do you do? Find a better job? Ask your boss for a pay rise? Cut your expenses? If you do that, one day you will find you are eating air. You yourself cannot manage inflation but you can manage your expenses, up to a point or else you will end up eating air for breakfast, lunch and dinner. Cutting cost can only be a temporary solution for the short term. You need to increase you income or your revenue sources. You need to grow.

How do you grow to out run inflation?

Rule #1: To beat inflation invest in yourself first.

Remember, in the previous article, making sound investment decisions , I had mentioned that you need to make investments. The first rule is to invest in you. Many investment analysts will talk you into investing in this scheme or that scheme but this takes money out of your pocket and puts it in someone else’s pocket. If you are at a point where the spare cash is very little, I would suggest that you invest in yourself and your children, if you have children. Forget all the fancy schemes out there.

When I say invest in yourself, I mean upgrading your capabilities. There are many things you can do to upgrade yourself. Try to be more presentable to others. Change or improve your image and self-image. Improve your skills or acquire new skills. Take a course of study to increase your knowledge base, learn something practical but there is one exception here – don’t do accounting as you will not learn any new skills, as they only teach you how to cut cost. Don’t try to cut cost, at least too severely. Cutting cost is wrong thinking. It focuses you too much on the problem and takes you away from potential solutions. I’m teaching how to bake bread at bachutha.com. Learning how to make bread will result in some lessening of your daily expenses. These are practical things you can do that will upgrade you self-image and your skill level and give you confidence. And without worrying about how to cut your monthly bills you would be improving your diet, your health and lessening your expenses. And that is how you grow and out run inflation.

How does inflation affect us?

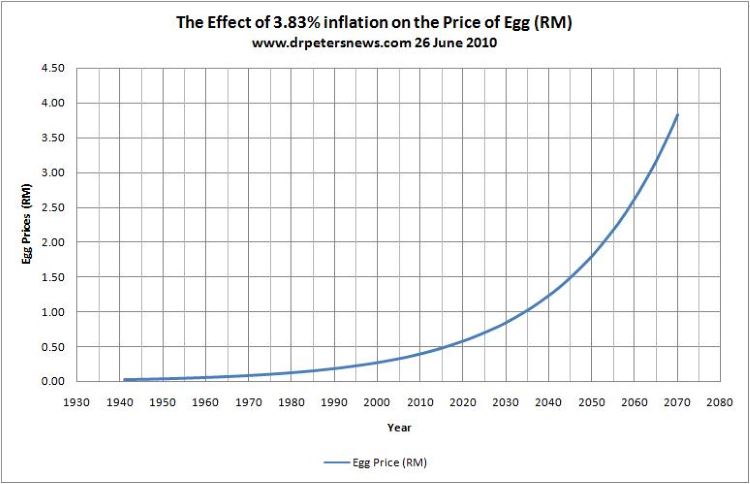

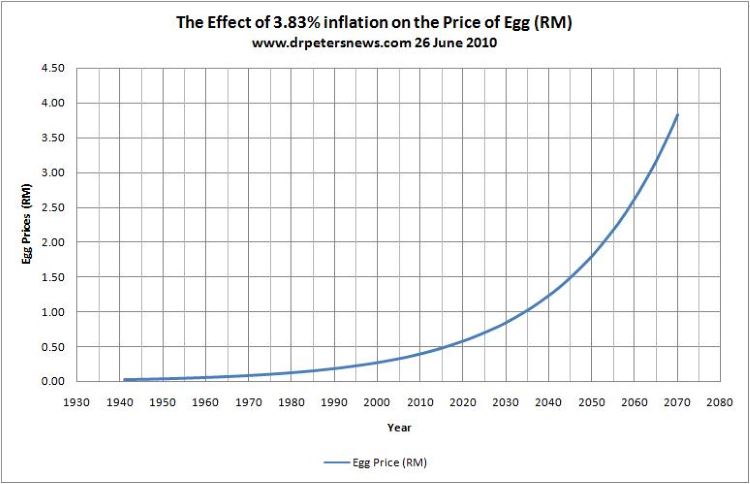

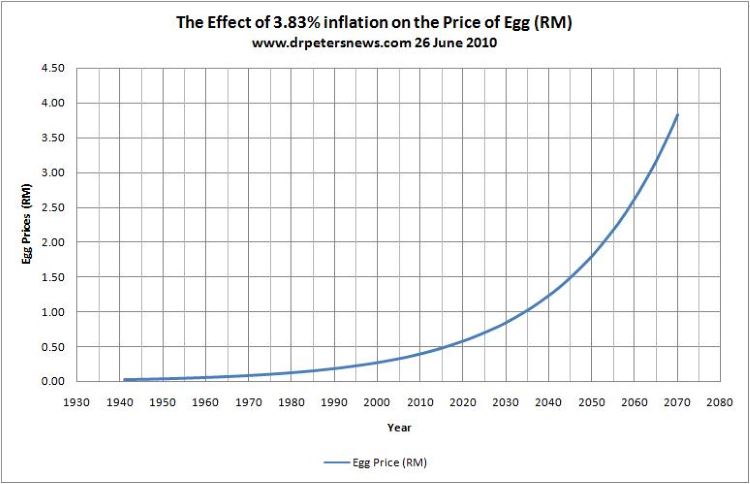

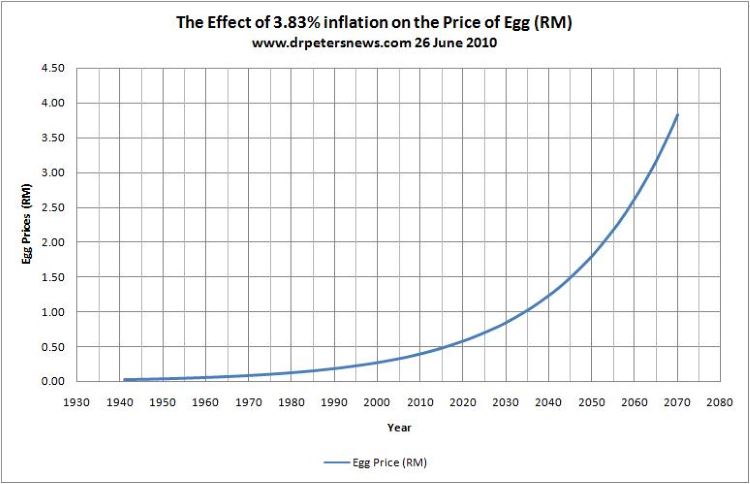

Most of us do remember what prices were when we were children. I remember in the 1960's, my parents gave me 20 cents for meals at the school ‘tuck shop’. Now days, I believe some parents are giving their children as much as ten dollars. My mum remembers that the price of eggs in the 1965 was 10 cents (RM0.10 or US$0.03) but now, in 2010 or 2011, it is 40 sen or US$0.13 (terminology changed from "cents" to "sen"). I did search the internet and found that the price of an egg was 3 cents in 1941 (US$0.01 at today’s exchange rate). See link: www.essortment.com, Malaysia and Singapore was one country under British rule back then. I prefer to use a longer time frame so that the overall trend, smoothing out the short term price fluctuation, may give more realistic results. That is a long term inflation rate of 3.83%! Which is very close to the government statistics of 4% rate of inflation. For those of you who want to know what the prices were in America back in the 1960s, you can refer to : www.thepeoplehistory.com. I couldn’t find data sources for other countries.

Now just look at the chart of Egg Inflation and observe what will be the price in 2020 and 2050.

Let us wait another 4 to 5 years and see if, in 2015, the price of an egg is RM0.50 (US$0.17). In 10 years, in 2020, it is expected to be about RM0.60 (US$0.20). This chart shows the effect of inflation and it is relative to the date you begin. The important point about this chart is that the egg price increases by x3 (three times more expensive) every 30 years. Would your pension plan generate a monthly revenue of x3 your current income, in 30 years’ time? How long do you expect to live for? The average person lives until about 85 years of age. So if you were born in the 60’s, by the time you leave this world, the price of an egg would be a RM1.50 (US$0.50). If you were born in the 1980’s by the time you conk out, the price of an egg would be RM3.17/- (US$1.05). And at 85, I tell you, you will have a lot more medical expenses then you have today, if you don’t take care of yourself today. What’s the morale of this story? …. Buy more eggs? … Invest in an egg farm?

Inflation has this singular effect, and that is, in your old age you will never be able to afford what you once took for granted during your youth.

If you want to do similar analysis with your own data please click on this link to go to my Inflation Calculator - Egg Inflation Page in order to do more analysis.

If you need to do more calculations off line please download my free Excel Worksheet based loan calculator, "Dr. Peter's Loan Calculator" and you can work off line.

Actually, I would like to take you back to basics and show you the bigger picture and then you would have a better understanding of inflation.

-Dr. Peter Achutha, 6th July 2011

Please do show me your appreciation of this article by Buying me a coffee.

And do get the "I Won" t-shirt

|